What is Going on with our Changing Market?!?

Joey Bergandi May 25, 2022

Real Estate

Joey Bergandi May 25, 2022

Real Estate

Our team is committed to continuing to serve all your real estate needs while incorporating safety protocol to protect all of our loved ones. In addition, as your local real estate experts, we feel it’s our duty to give you, our valued client, all the information you need to better understand our local real estate market. Whether you’re buying or selling, we want to make sure you have the best, most pertinent information, so we’ve put together this monthly analysis breaking down specifics about the market. As we all navigate this together, please don’t hesitate to reach out to us with any questions or concerns. We’re here to support you. Joey Bergandi, Velocity Realty, #02032632 |

| The Big Story |

| Rising rates may not normalize the housing market, but they may help inflation |

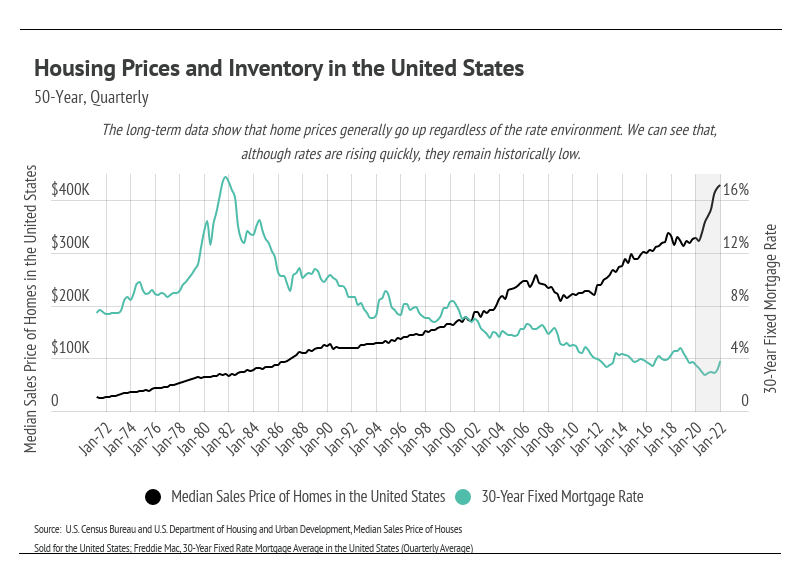

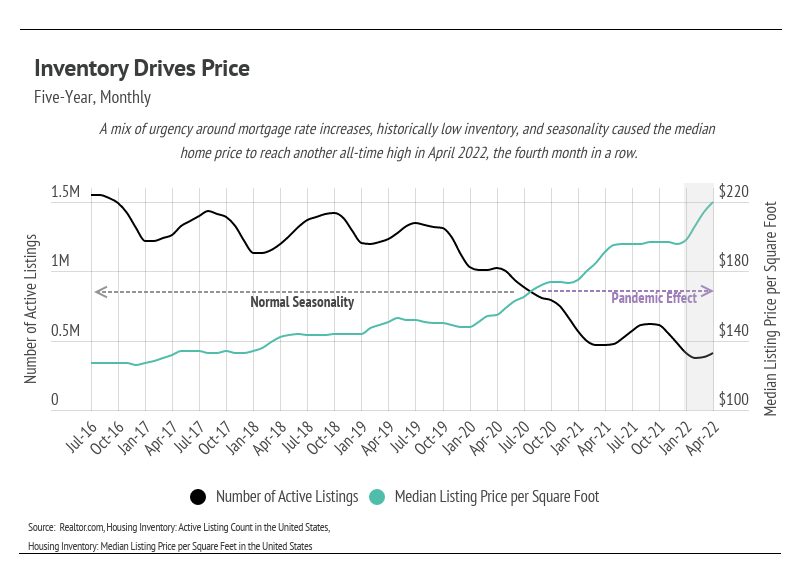

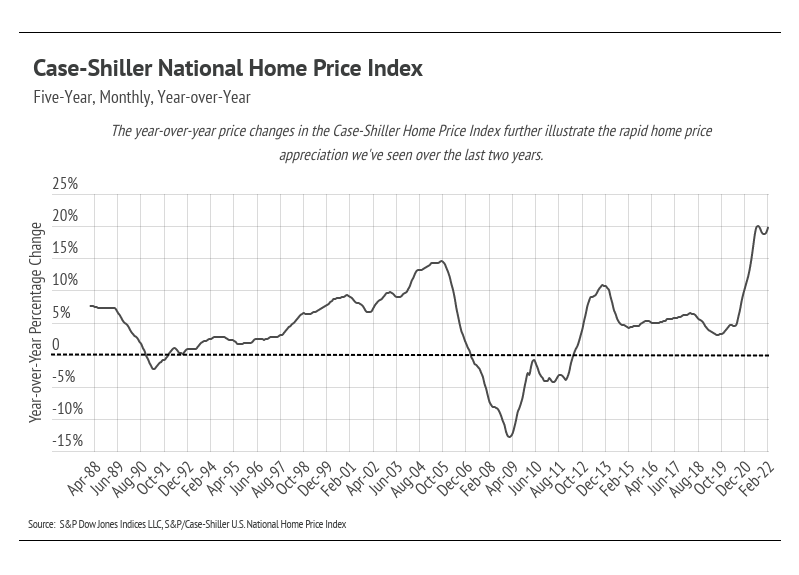

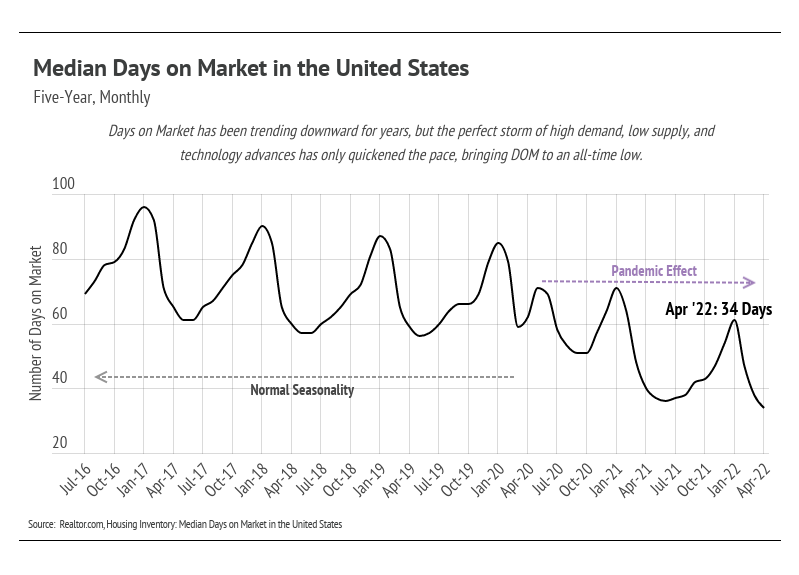

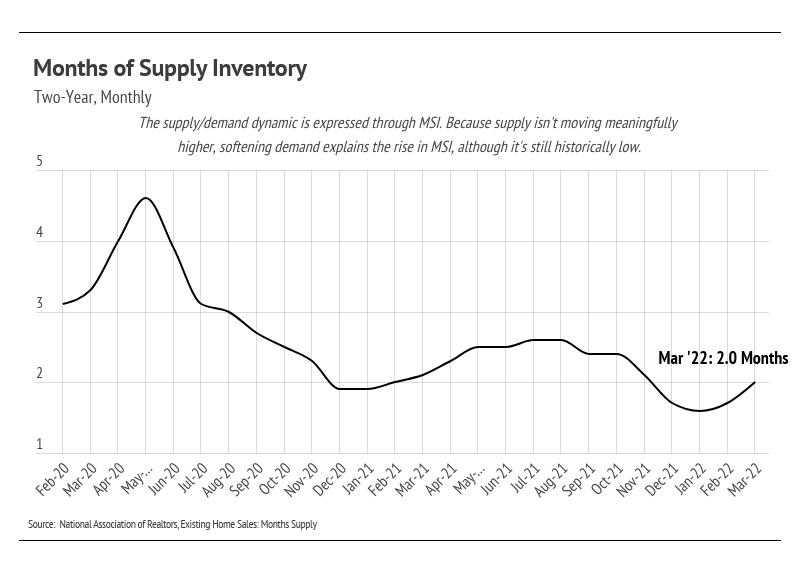

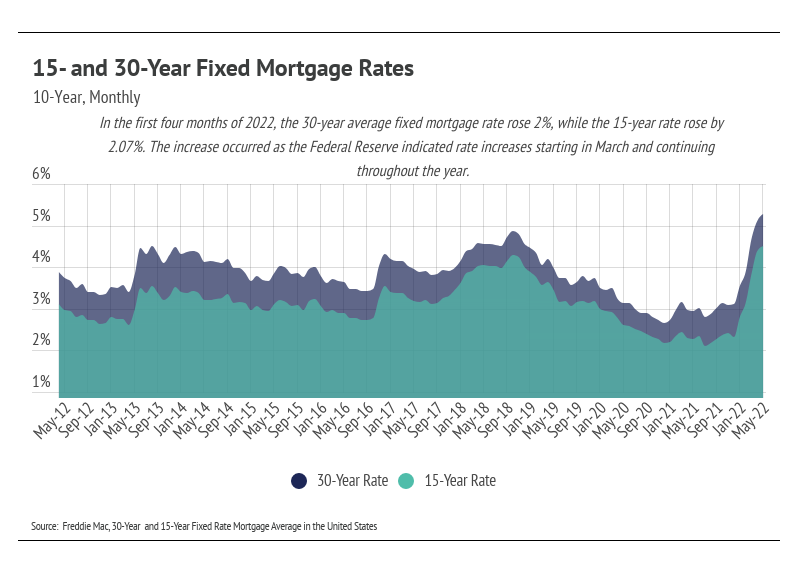

Quick Take:Record high home prices aren’t going away, even with rising rates. However, the rising rate environment will prevent a significant amount of money from entering the economy.With nearly full employment, the Fed is hyper-focused on price stability — the other half of the Fed’s dual mandate — which means higher mortgage rates through the rest of the year.Demand is softening slightly now that the average mortgage rate jumped 2% in the past four months. Note: You can find the charts & graphs for the Big Story at the end of the following section. |

| Prices continue to rise as mortgage rates hit 13-year highs |

After the Fed’s May meeting, Fed Chair Jerome Powell announced that they are raising their benchmark rate by 0.50%, the largest hike since 2000. Earlier this year, the Fed was expected to raise interest rates by 0.25% at least six times this year, going from 0% to 1.90%. Now that each increase will most likely be 0.50%, the market expects the federal funds rate to reach 2.75% to 3.00% by the end of the year, which would be the highest in 15 years. Although the fed funds rate doesn’t directly affect mortgage rates, the rate hike moves into the broader economy quickly. Over the past four months, mortgage rates have moved about 2% higher for both 30- and 15-year fixed mortgages. Economists now estimate that 30-year mortgage rates could climb above 6% by mid-2022, which is fast approaching. Because the Fed indicated the path of rate hikes for the rest of the year, we expect mortgage rates to top out at around 7% this year for prime borrowers. A rising rate environment increases short-term demand as buyers try to lock in lower mortgage rates, which is what we are seeing now. The increased short-term demand is driving prices right now outside of supply, which begs the question: Will higher mortgage rates actually drive down prices? No, they sure won’t. Using history as our guide, we can see that home prices continued to rise even as mortgage rates peaked at over 18% in the 1970s, which would translate to about $7,500 per month on a $500,000 loan. Luckily, we aren’t going back to those rates. Higher rates, however, will do exactly what the Fed intends, which is to take money out of the economy and decrease overall demand. The average 30-year mortgage rate was 3.11% in December 2021, rising to 5.10% by the end of April 2022. If you bought a home in December and financed it with a $500,000 mortgage loan at 3.11%, your monthly spend on principal and interest would be $2,138 — versus $2,715 if you got the same loan in April 2022 at 5.10%. Over the life of the loan, you’ll spend $207,720 more at 5.10%. From the Fed’s perspective, that equates to roughly $500 less per month to spend on goods and services, bringing down aggregate demand when we multiply that reduction of disposable income across households. The gradual rate increases are meant to avoid sending the economy into a recession. In addition to rising rates, supply still drives home prices. In April, the housing supply ticked up ever so slightly, but it’s still 60% lower than the number of homes on the market in April 2020. We are entering what is traditionally the hottest time of year for the housing market with a record low supply of homes. Over the past four months, which had the lowest inventory on record, home prices increased 12%. If you are considering buying a home, there aren’t many reasons to wait. Home prices and rates are still rising. The low supply continues to make the market extremely competitive. We are starting to see some softening in demand, but not nearly enough to balance the supply side of the market. |

| Big Story Data |

|

|

|

|

|

|

| The Local Lowdown |

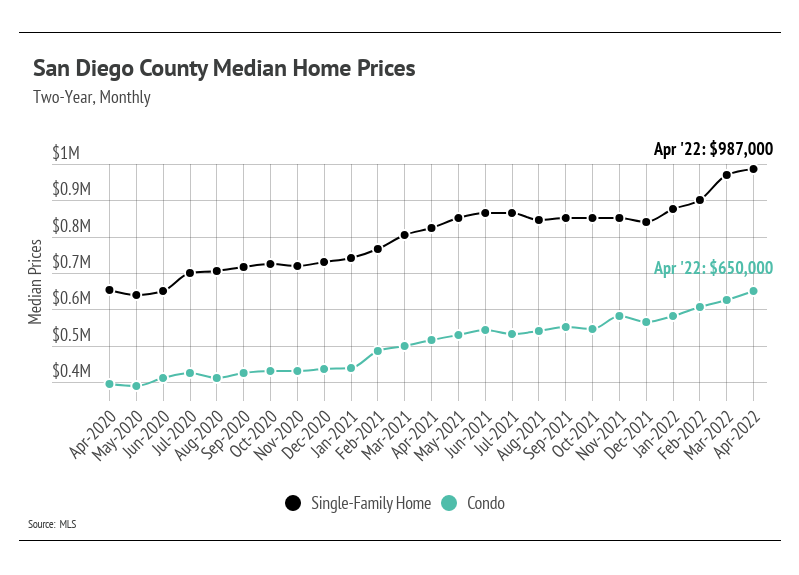

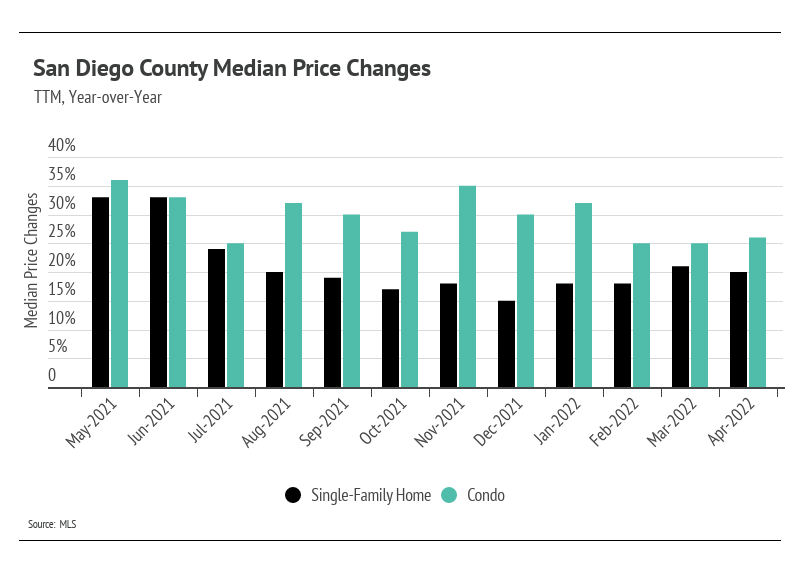

Quick Take:Home prices in San Diego County reached record highs in April; short-term demand boomed as buyers tried to lock in lower mortgage rates.The second quarter of 2022 will indicate whether the market is moving toward or away from normalization. April data show that the number of homes for sale decreased, protecting home prices from a reversal.Despite some softening of demand as rates increase, low housing supply will continue to drive prices up unless an unexpected number of new listings come to market.Note: You can find the charts/graphs for the Local Lowdown at the end of this section. |

| Home prices continue to rise despite rising rates |

Single-family home and condo prices rose to all-time highs in April 2022, but it’s still too early to determine how increasing rates will affect the market. Mortgage rate hikes only lower demand in the long term. In the short term, demand increases as buyers try to lock in lower rates. Over the past four months, the average 30-year mortgage rate has increased 2%, which means a 27% increase in monthly mortgage payments, yet prices keep moving higher. The factors now affecting home prices are anticipated to have mixed results, unlike the past two years when all factors caused prices to increase. Rising interest rates, which will hopefully curb the rising 40-year-high inflation rate, will make homes less affordable and dampen demand over the rest of the year. They may, however, also lower supply as current homeowners reconsider their plans to sell. Many homebuyers are also home sellers, moving from one home to another. Newer homebuyers and homeowners who refinanced over the past two years locked in one of the lowest rates in history, making moving a more difficult financial decision. This could keep supply unseasonably low with fewer new listings coming to market, as we saw in April. In general, the Fed doesn’t have a tool to deal with supply-side issues: It uses monetary policy to affect demand, making money more or less expensive. As a result, the Fed’s rate hikes may result in unintentional effects on supply. In San Diego County, the lack of housing supply will keep prices rising in the coming months. |

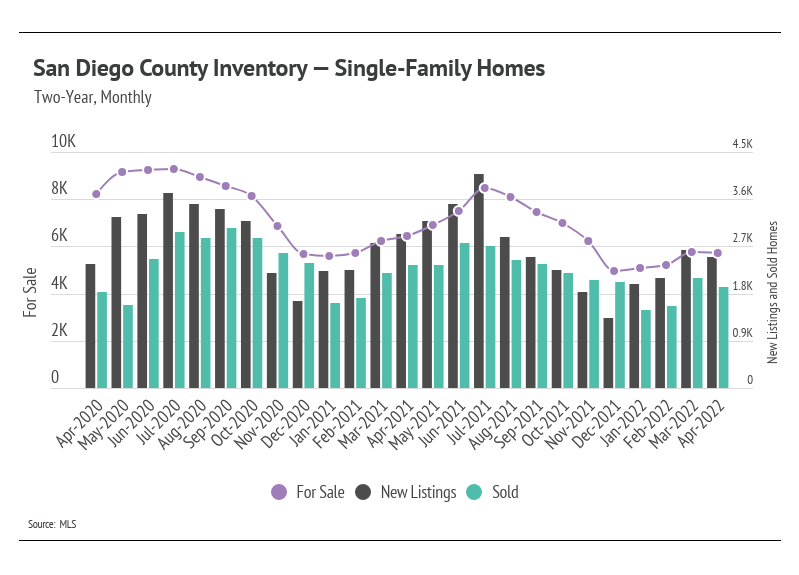

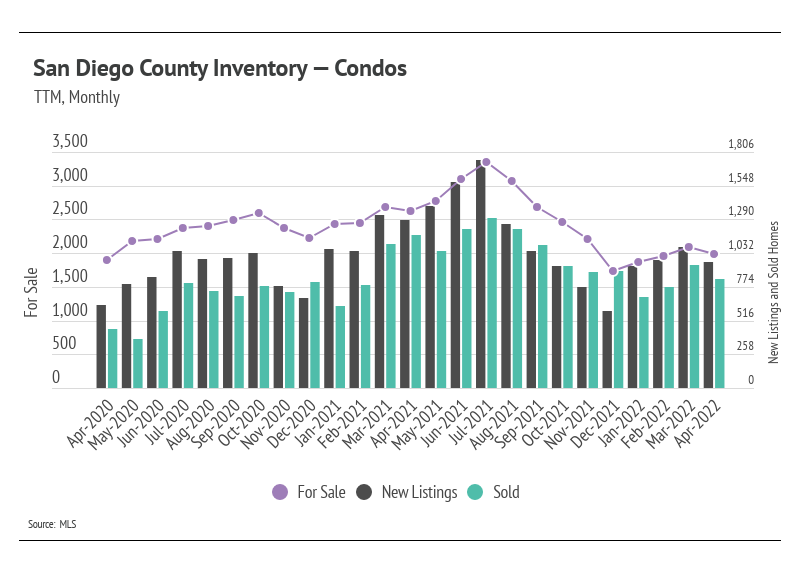

| Inventory dips, seasonally abnormal |

| San Diego County’s housing inventory declined in April, which deviates from the seasonal norm and serves as an early indicator that home supply will remain depressed this year. The high demand and lack of new listings over the past year brought single-family home and condo supplies to record lows. Although the first quarter of 2022 had the lowest inventory on record, we were pleased to see that inventory did increase, a trend that usually holds until mid-summer. With April inventory declining rather than rising, the next three months will help us forecast how inventory levels will trend for the rest of the year. Even though inventory is low, sales remain incredibly high, especially when we account for available supply. This trend once again highlights the high demand in the area. Sellers can expect multiple offers, and buyers should come with competitive offers. |

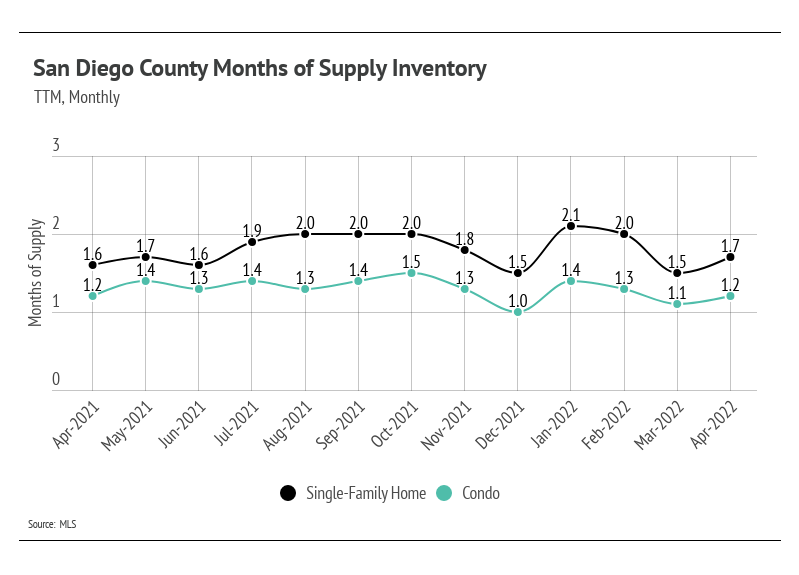

| Months of Supply Inventory further indicates high demand relative to supply |

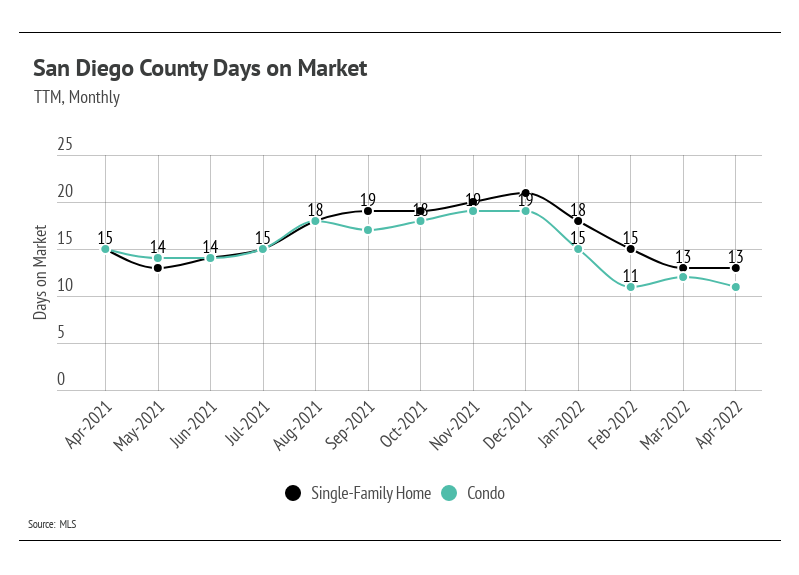

Homes are selling faster than ever. Buyers must put in competitive offers, which, on average, are around 6% above list price. Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The average MSI is three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Currently, single-family home and condo MSIs are exceptionally low, indicating a strong sellers’ market. |

| Local Lowdown Data |

|

|

|

|

|

|

Stay up to date on the latest real estate trends.

You’ve got questions and we can’t wait to answer them.